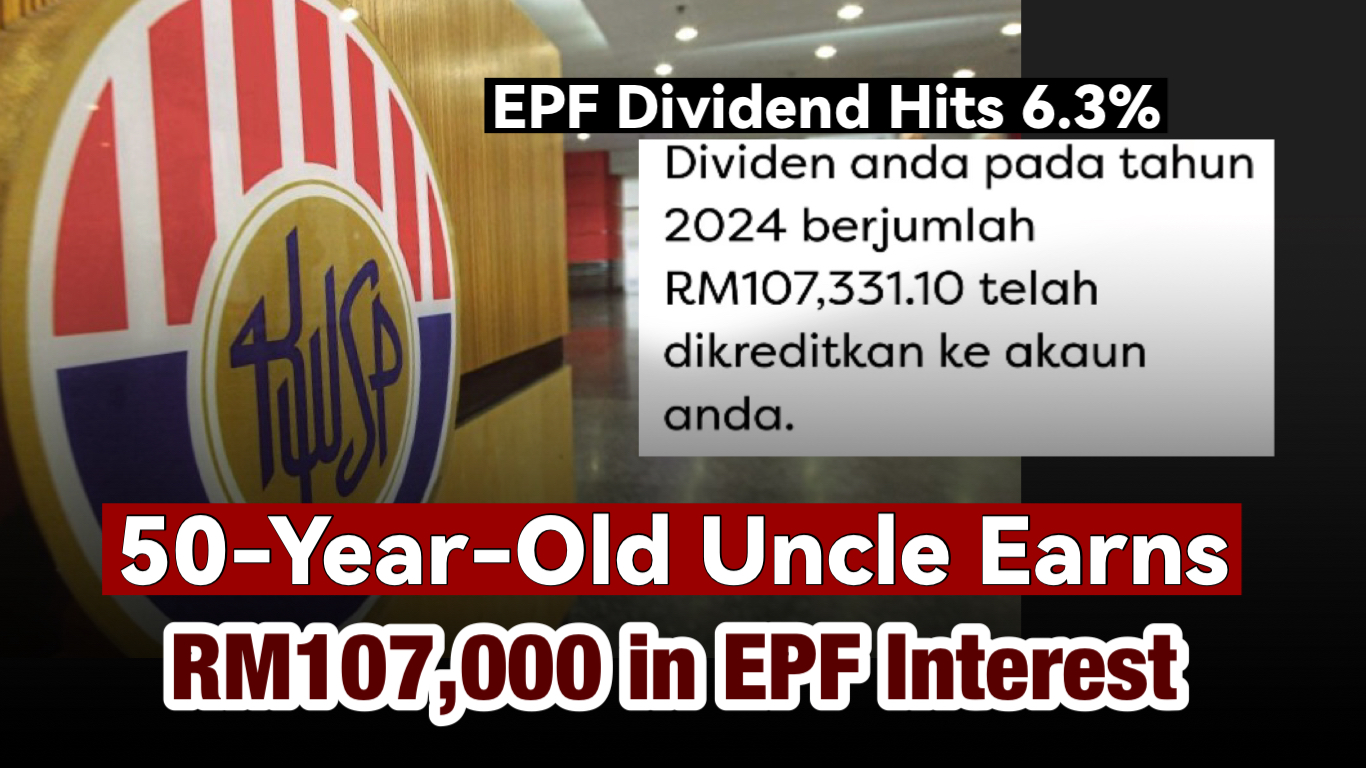

EPF Dividend Hits 6.3%! 50-Year-Old Uncle Earns RM107,000 in Interest

March 1 – The Employees Provident Fund (EPF) of Malaysia has announced a 6.3% dividend rate for 2024, marking the highest return in six years. This news has brought excitement among EPF members, with many celebrating their increased retirement savings.

One retiree, known as Uncle Wisely, shared on Xiaohongshu that he earned a staggering RM107,331.10 in dividends this year—an amount sufficient to cover his annual living expenses. He also revealed a snapshot of his EPF account, showing a total balance of RM1,853,091, demonstrating the power of long-term savings and compound interest.

EPF confirmed that both the Conventional and Shariah savings accounts would receive the same 6.3% dividend, a 0.8% increase from 2023’s 5.5%, making it the highest payout since 2018. In total, EPF is distributing RM73.24 billion in dividends to its members.

Although still short of the 6.9% peak in 2017, this year’s increase provides a boost for retirees and savers alike.

EPF Dividend Rates Over the Past 10 Years:

• 2023: 5.50% / Shariah 5.40%

• 2022: 5.35% / Shariah 4.75%

• 2021: 6.10% / Shariah 5.65%

• 2020: 5.20% / Shariah 4.90%

• 2019: 5.45% / Shariah 5.00%

• 2018: 6.15% / Shariah 5.90%

• 2017: 6.90% / Shariah 6.40%

• 2016: 5.70%

• 2015: 6.40%

• 2014: 6.75%

Between 2010 and 2017, EPF consistently delivered over 6% returns, peaking in 2017 at 6.9%. However, dividends declined in subsequent years due to global economic uncertainties, the COVID-19 pandemic, and market fluctuations.

With the latest rebound, EPF members can look forward to better returns and enhanced retirement savings in the years ahead.